Public Markets

Institutional Investor Magazine’s analysis: Investors Know They Own Too Much Tech. This Analysis Shows That It’s Worse Than They Think

“A yet-to-be-released paper from data science firm Syntax Advisors entitled, “Do You Know What You Own? How Much Technology is Really in the S&P 500?” shows that as of September 30, institutional and other investor portfolios that use market cap-weighted index funds tied to the S&P 500 had a tech exposure rate of 42 percent. In contrast, most traditional measures — which generally group companies according to broad sectors such as information technology, industrials, and financials — put tech exposure in the S&P 500 at 27.6 percent.”

Syntax’s methodology involves re-classifying the companies in the S&P 500 away from GICS (the Finance industry’s dominant classification hierarchy) because of its perceived rigidity, and allows for more nuanced definition of business categories to account for businesses with meaningful technology operations and revenue drivers.

Conglomerates: How does the market figure out “sum-of-the-parts?”

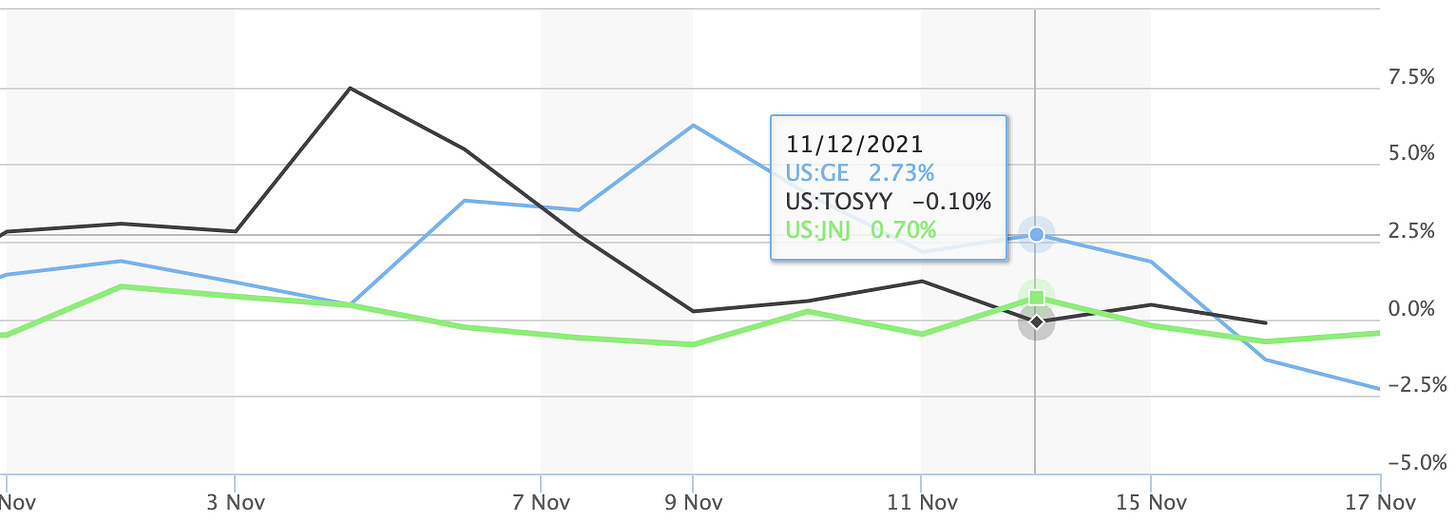

There have been a number of recent examples of companies unbundling themselves from diversified conglomerates to more streamlined identifiable businesses. There is a longstanding debate among investors—does a conglomerate structure work? Looking at the recent companies who have announced splits or spinoffs in 1H November, it’s actually surprising how little the stocks moved after announcing spinoffs…Snoozefest!!

Johnson & Johnson (JNJ): Breaking itself into a consumer products company & a medical company.

GE is carving firm up into three divisions: Aviation, Power & Healthcare.

Toshiba is also splitting into an Infrastructure co, a Device co and a Holding co.

However, there are also examples where it’s very clear that the market misplaces a company because they can’t really see the underlying value clearly. Check out the stock price of Spectrum Brands when they announced the sale of their Home & Hardware division in early Sept for more than the entire market cap of the firm!

As with many topics in the market, there isn’t a crystal clear answer here. One thought to leave you with: Toshiba, GE and Johnson & Johnson are massive firms with lots of analysts covering them. Spectrum Brands is a relatively small, unknown company without much volume or analyst coverage. Next time you see someone mention a “sum-of-the-parts” analysis, dig in and don’t take the math at face value!

Private Markets

Return of the take-private: Casper sells itself to private equity firm Durational Capital

The Canadian Venture Capital Association, the private markets industry association representing Canadian managers, is out with its Q3 industry report:

Deal activity is already at YTD all-time highs (C$11.8bn thru Q3)

“There were 55 megadeals (CAD $50M+) year-to-date, accounting for 74% of total dollars invested in the year so far. Notable megadeals in Q3 included Vancouver-based Dapper Labs’ CAD $319M closing, Toronto-based Clearco’s CAD $270M funding, and the investment made in Montréal-based Blockstream for CAD $265M.”

Privcap is out with an episode on the role of ESG in PE investing with trailblazing investor Bregal Partners: aligning with ESG-focused founders, carbon-neutral goals for portfolio companies, using ESG factors for risk screening and value creation.

The Rational Metaverse

Pivoting once again to make this section more relevant to our mandate. We’ll be exploring news and other content related to the rational application of Metaverse, AR, Web3 to work and leisure. Our most read articles and posts on this topic have been Nike, Fortnite, La Liga and related businesses/technologies bridging the physical and digital world.

Miramax is suing Quentin Tarantino over Pulp Fiction NFT plans

Barbarians at the pixelated gates: Orlando Bravo (of Thoma Bravo) on the investability of the Metaverse

Immersive sports experiences: Unity’s Sports executive, Peter Moore (ex-Liverpool FC) demoed Unity Metacast, an immersive sports viewing experience. The demo utilizes footage of a UFC bout and “automatic cinematic dolly track generation” to allow viewers to zoom in, out and around the ring throughout the fight to see it from all angles.

“Unity Metacast uses volumetric technology, which encompasses the process of capturing, viewing, and interacting with the real-world, from moving people to static objects, in 3D. This content can then be viewed from any angle, at any moment in time, giving audiences the ability to see every bead of sweat, blow, takedown and submission, as if they were going toe-to-toe on the famous Octagon canvas themselves.”

Us at 25—An Interview Question to Chew On

Interviews are one of the few times that folks in business get introspective with peers. What makes you tick? Are you a good fit with this company? What are you looking for in life?

Here’s a question we were discussing that we intend to use soon: “What is more gratifying to you—feeling like you outsmarted the game and won or that you put in the necessary hard work and prevailed?”

There are positives and negatives implicit in both answers, and probably some signaling about what kind of roles a candidate is suited for.

If we’re hiring for an analyst role, do we want an analyst who builds a model from scratch or modifies an existing model to fit our business? Advantages to both!

If we’re hiring for a sales role, do we want someone who is a cold-calling machine, or someone who finds counterintuitive ways to get in front of prospects?

If we’re hiring for an operations role, does the work involved necessitate creativity or grinding out defined workflows?

If you’re interviewing now, the odds you’ll be asked this question are essentially zero. But you can always turn the tables and ask the interviewer: “Who do you think is a better fit for this role…someone who is a creative problem solver or a more structured, sequential thinker?”